Exciting news for all Vault owners and the StakeWise community! 🎉

We’re thrilled to announce the release of Vaults v4.0 — a big leap forward in scalability, efficiency, and new capabilities in the whole staking ecosystem.

This release brings a host of improvements to how Vaults work, introduces MetaVaults, and adds new ways to redeem and distribute rewards. The upgrade is now live and available as an optional update for all existing Vaults.

StakeWise’s goal has always been to make liquid staking on Ethereum more flexible, more secure, and available to every type of user, positioning our protocol as the go-to choice for retail and institutional stakers alike. With this release, we’re excited to get one step closer to achieving our goal.

As with previous upgrades, upgrading to v4 Vaults requires updating your operator service to ensure compatibility and smooth operation. Follow this v4 upgrade guide for more details.

For technical implementation details and security verification, please see release notes and our security audit report.

Let’s dive into what’s new! 🤓

Pectra Validator Upgrade

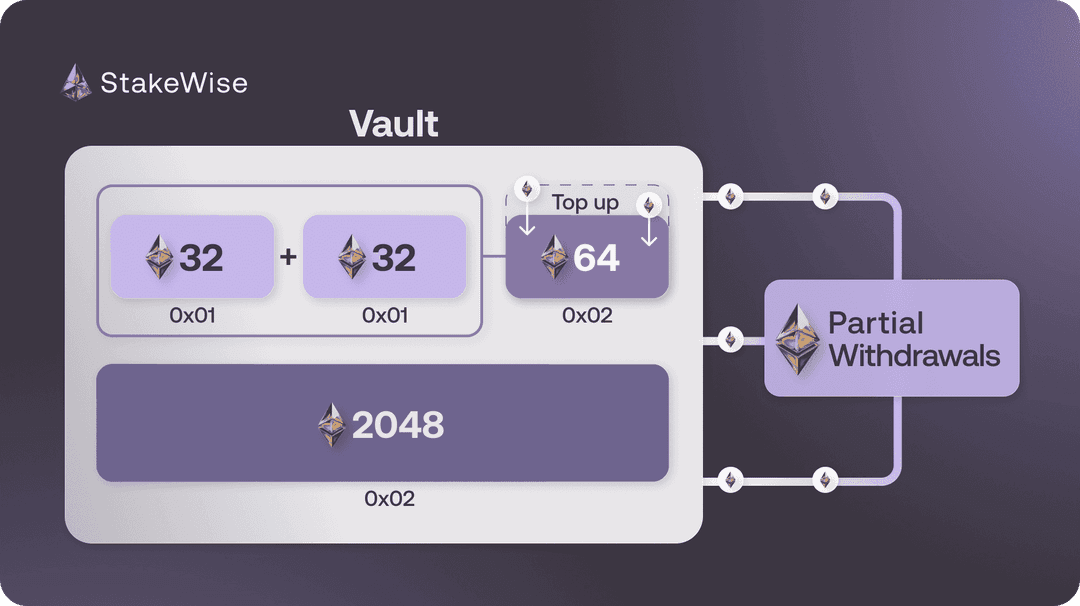

Vaults v4.0 support EIP-7251 (variable effective balances up to 2048 ETH) and EIP-7002 (execution layer triggerable exits), enabling advanced validator management features such as consolidation, smart-contract-triggered withdrawals, and top-ups.

New validator-related functions make it possible to:

Register both 0x01 and 0x02 validators within the same Vault, ensuring a smooth transition from legacy 0x01 validators while supporting new Pectra-ready 0x02 validators, and allowing Vault operators to execute inflow and outflow requests with maximum speed and efficiency.

Consolidate existing 0x01 validators into 0x02 validators, enabling variable validator balances up to 2048 ETH. This reduces the total validator count, lowers infrastructure overhead, and enables operators to create sophisticated strategies around liquidity management for their Vault.

Top up existing 0x02 validators with additional ETH or GNO to increase validator balances without creating new validators. Benefits include getting your ETH earning rewards faster without waiting for 32 ETH to accumulate first. Since validators start earning on additional balances immediately, this positively impacts APY.

Trigger both partial withdrawals and full validator exits directly from the Vault contract, allowing excess ETH above 32 ETH to be withdrawn while keeping validators active and validating. This significantly speeds up ETH withdrawal under the right network conditions, potentially reducing the time users have to wait for funds.

All validator operations can be called only by the ValidatorManager or by providing their valid signature.

With these enhancements, Vaults v4.0 make the transition to Pectra seamless — providing cutting-edge validator tools that give Vault operators an edge in the competitive staking industry, while preserving trust and security beloved by users.

🔧 Full technical details are available in the v4.0 changelog →.

MetaVaults: The Smart Way to Scale Ethereum Staking

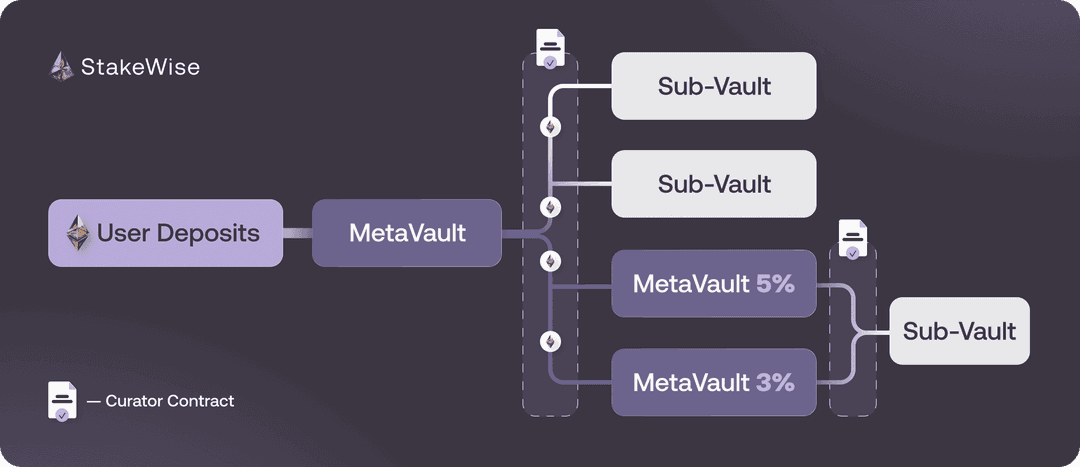

Another major feature of v4.0 is MetaVaults. MetaVaults don’t run validators directly, instead, they delegate assets to other Vaults (called sub-vaults within the MetaVault structure) that handle the actual validator operations. Sub-vaults can themselves also be MetaVaults.

How MetaVaults work:

MetaVaults receive user deposits and distribute them across sub-vaults according to the curator strategy.

The Curator is a new contract that manages how ETH is allocated to and withdrawn from sub-vaults. To be used, a curator contract must be approved by the DAO and added to the CuratorsRegistry contract.

To begin with, we’re adding one curator contract to be approved — the BalancedCurator — which distributes and withdraws assets evenly across all 100% LTV Vaults, improving the distribution of assets staked from the Stake page within the StakeWise app.

We envision a future where any operator and distributor can request and receive DAO approval for its Curator strategy, taking advantage of the flexible fee management possibilities across multiple Vaults, and tapping into a diverse operator set that includes distributed validators, community operators, custom MEV-maximizing strategies, and more.

Benefits of MetaVaults

Customizable asset placement: Multiple layers of Vaults can sit on top of each other to enable sophisticated setups that utilize a mix of underlying validators to maximize redundancy, liquidity, and rewards. For example, a separate MetaVault can be deployed per each institutional customer, tapping into a single underlying sub-Vault that runs all validators, to allow asset segregation among users while maximizing validator fleet efficiency.

Flexible fee structures: Different MetaVaults can charge different fees for different clients — especially helpful for establishing flexible fee structures for institutional clients.

Ahead of requesting deployment of a Curator contract and launching your own MetaVault, feel free to contact the StakeWise team for assistance.

More Customization Options

Vault parameters

Now, the Vault admin can change the admin address of the Vault and update the fee percentage after deployment.

Note that fees can only be increased by up to 20% of the current rate at a time (for example, from 5% to 6%), with a mandatory 3-day delay between updates.

Reward Splitter

Vaults v4.0 enhance the Reward Splitter with new automated withdrawal capabilities for fee shareholders. The update introduces a claimer role that can trigger exits on behalf of shareholders using the new enterExitQueueOnBehalf and claimExitedAssetsOnBehalf functions, resulting in direct claiming of ETH fees directly to shareholder addresses.

Simplified Validator Management

v4 Operator no longer requires pre-uploaded deposit data for validator registration — it generates deposit data automatically during registration.

⚠️ Important: To support this new flow, you must assign your operator wallet as the Validator Manager in the Vault settings. How to Set Up Validators Manager.

Technical Improvements

Vaults v4.0 isn’t just about new features — we’ve also made everything faster and more efficient.

Ethereum has strict limits on how large smart contracts can be (EIP-170), and our Vaults were hitting those limits. We implemented several optimizations to reduce contract size.

The approach focused on eliminating duplicate logic, extracting shared functionality into libraries, and removing deprecated or unused code, streamlining how Vaults handle data.

For Gnosis Chain users, we’ve upgraded the token conversion system to work more efficiently with CowSwap.

The result? Vaults that perform better while supporting more features than ever before.

For full technical details of all optimizations, see our v4.0 changelog →.

Final Thoughts

Vaults v4.0 marks a significant step forward for StakeWise and liquid staking. MetaVaults, Pectra compatibility, and streamlined redemptions deliver the tools you need for tomorrow’s staking landscape.Upgrade when you’re ready — your Vault, your timeline, your choice.