MetaMask’s Use Case

In 2024, MetaMask—one of the world’s leading self-custodial crypto wallets—launched its Pooled Staking product to millions of wallet users worldwide with the help of StakeWise.

Available through the MetaMask Portfolio interface, Pooled Staking has already helped ~100,000 users stake any amount of ETH to passively earn rewards from holding the asset.

When scoping out a Pooled Staking offering, MetaMask wanted a solution that could simultaneously deliver enterprise-grade control, wallet-native security, and fast execution—without compromising the self-custodial promises users expect from MetaMask.

Specifically, MetaMask wanted:

Complete control over the staking setup. MetaMask needed the flexibility to configure every possible detail around the fee structure and distribution, MEV, and compliance, without being dependent on third parties.

Ability to use own nodes. MetaMask sought to utilize the node infrastructure of its sister company Consensys Staking to maximize potential staking rewards and keep validator keys in-house for maximum security.

Fast go-to-market using established solutions. MetaMask prioritized rolling out the Pooled Staking offering quickly and looked for a secure and battle-tested partner to minimize internal cost and development effort.

Pooled Staking: Powered by StakeWise

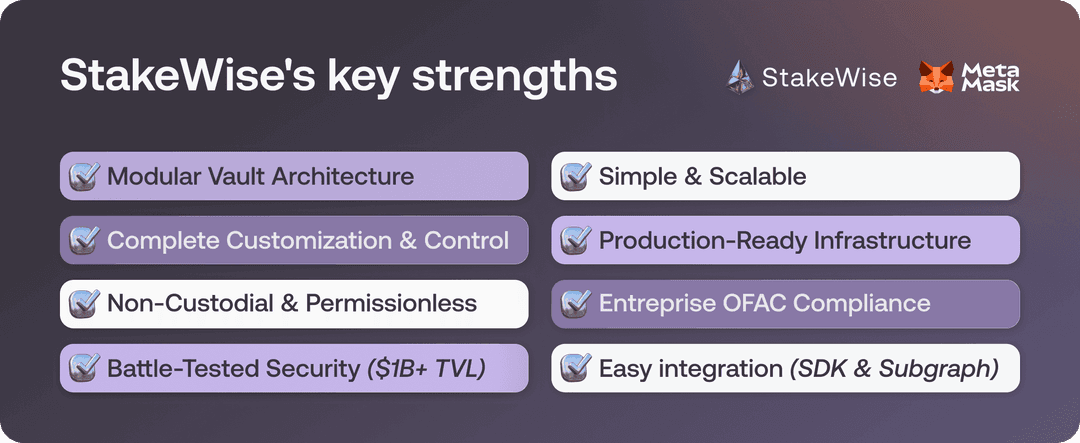

StakeWise Vaults were a perfect match for the MetaMask Pooled Staking product requirements in terms of capabilities and security.

Unlike one-size-fits-all pooled or liquid staking products, StakeWise Vaults are based on a modular architecture and provide isolated, highly customizable staking pools where all the parameters are controlled by the pool owner. This allowed MetaMask to:

Deploy an independent staking pool with a custom fee

Set Consensys Staking as the sole node operator

Configure a compliant MEV arrangement

Maintain a blocklist to comply with OFAC sanctions

Avoid creating tokenized receipts for user deposits, with the possibility to add tokenization in the future

This combination of configurability and isolation made StakeWise Vaults uniquely suitable for a wallet distribution model, where the product must be flexible enough for institutional requirements while remaining simple for retail users.

In addition to these customizations, MetaMask benefited from the permissionless and non-custodial nature of StakeWise Vaults, allowing wallet users to stake assets without the need to trust either MetaMask or StakeWise with management of the funds and processing of withdrawal requests.

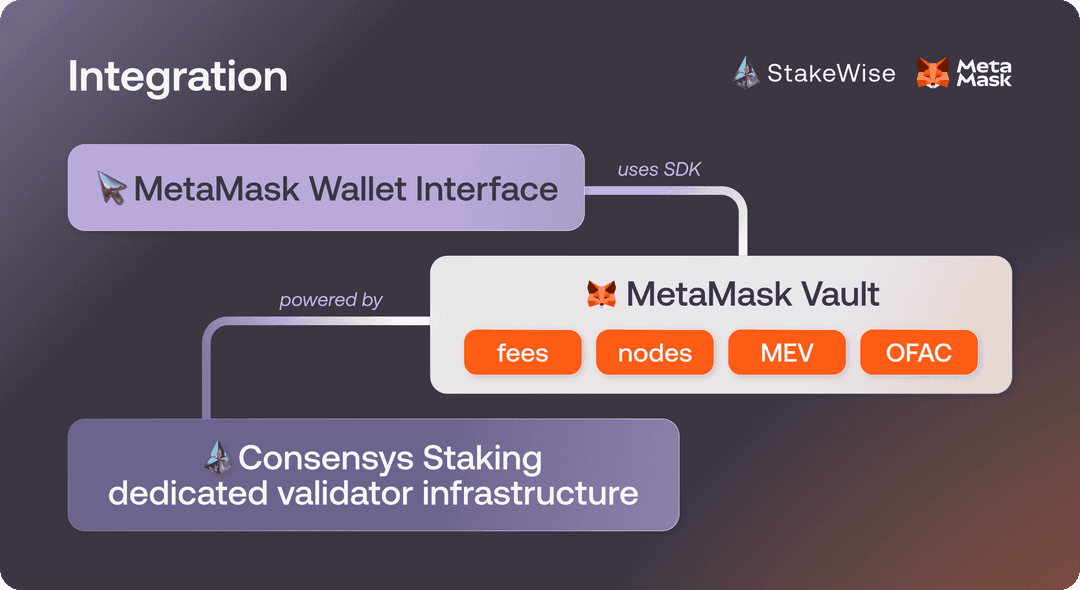

Integration Details

MetaMask Pooled Staking is based on a dedicated StakeWise Vault configured and owned by the MetaMask organization. Its admin wallet controls all the customizable parameters of its staking environment, including the staking fee, fee distribution, choice of the node operator, MEV relays, tokenization approach, and blacklist of OFAC-flagged wallets. This configuration is controlled via the StakeWise dApp interface, or by interacting with the smart contract of the Vault directly.

The user interface of MetaMask Pooled Staking is custom-made by the wallet team and is part of the wallet functionality. It utilizes the StakeWise SDK for calling the relevant Vault smart contract functions to deposit and withdraw assets from staking. The interface also utilizes the StakeWise subgraph to show general and personalized staking statistics to MetaMask Pooled Staking users.

This architecture let MetaMask ship a fully branded, wallet-native staking experience while relying on StakeWise for the underlying Vault framework, developer tooling, and onchain data layer.

Results

MetaMask Pooled Staking is a rapidly growing product that has attracted over $150,000,000 in staked assets from ~100,000 users to date.

It benefits from the battle-tested smart contract infrastructure of StakeWise that handles over one billion dollars of staked assets, and can be easily scaled further without loss of performance.