Launched in February 2025, StakeWise Boost is a production-tested yield amplification strategy that takes advantage of the positive spread between the staking APY and the borrow cost for ETH on the Aave lending market to increase users’ APY.

Genesis Vault, Chorus One - Max MEV Vault, and NodeSet Vault, among others, have benefited from offering StakeWise Boost, increasing their total staked assets by at least 100% each. Their clients were seeking:

Yield enhancement with a conservative risk/reward profile. Users asked for strategies that earned moderate additional rewards in exchange for low additional risk.

A simple way to utilize stake in DeFi for extra rewards. Customers wanted to skip the complexity of navigating the DeFi landscape on their own, preferring to use a one-stop solution that offered an easy UX.

Exposure limited to blue-chip protocols and selected Vaults. Clients sought to minimize the smart contract risk involved in deploying tokens in DeFi and staking ETH with unknown operators, preferring to interact with as few trusted counterparties as possible to achieve the end result.

On the service provider side, Vault owners sought a competitive advantage when pitching their staking services to prospective clients and were interested in increasing the profitability and unit economics of their products.

StakeWise Boost was developed to address these needs and has contributed to significant growth in user portfolios and Vault profitability.

A blue-chip DeFi strategy made simple

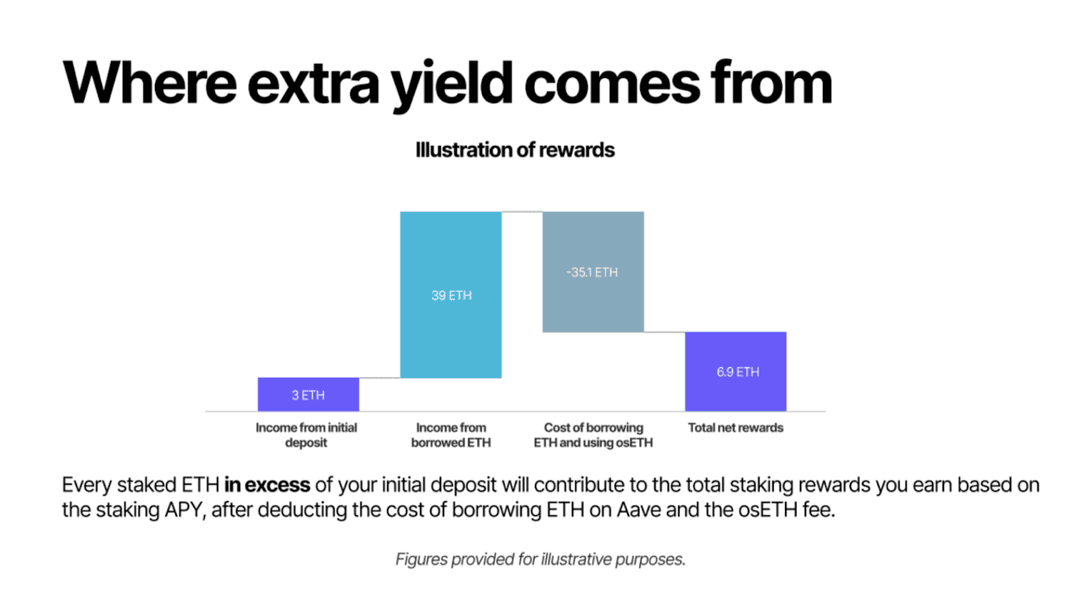

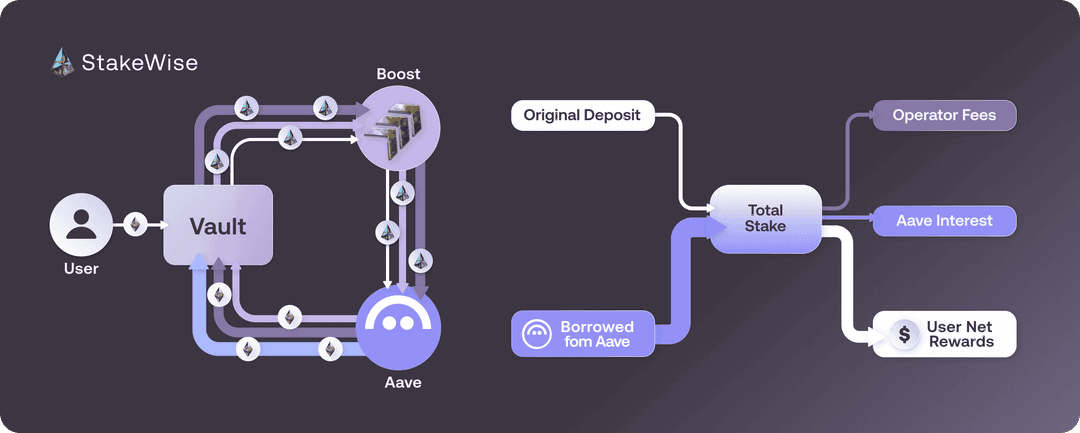

Built into every Vault by default, Boost allows users to establish a large ETH borrow position on Aave and stake borrowed ETH in the selected Vault. Over the mid term (6+ months holding period), this generates additional income for stakers equal to 1–3 percentage points above the usual staking rate, for a total APY of approximately 4–6%. Here’s an illustration of the calculations involved:

Boost is enabled for every Vault by default unless the Vault owner has explicitly chosen to prohibit osETH minting in the Vault.

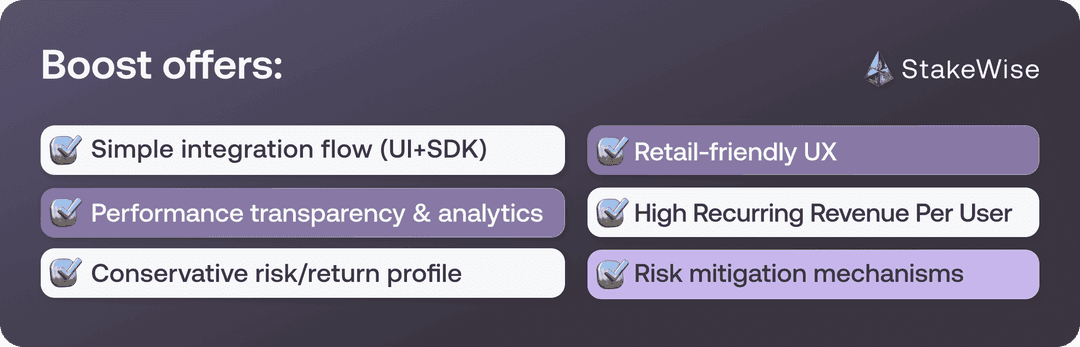

The key advantage of the strategy for users is the ability to rely solely on the StakeWise UI and smart contracts when interacting with lending markets and establishing a position. This reduces the number of steps and interactions from 40+ to just 1, allowing users to enter and exit the strategy with ease.

Boost is also known for its predictable returns over the medium term, based on actual and backtested data on staking APYs and Aave borrow rates going back to December 2023. This gives users peace of mind regarding the risk they take on in exchange for extra rewards. The actual performance of Boost since inception, modeled on participation in the Genesis Vault, can be found here 🔗.

StakeWise Boost is also unique in allowing users to maintain exposure to specific node operator(s) and a limited number of blue-chip protocols. Instead of exposing stakers to a wide network of operators and multiple protocols at once, as is common in alternative strategies, Boost allows clients to benefit from the advantages of working with select node operators (e.g., performance, security, insurance, fees) while minimizing exposure to only StakeWise and Aave—two protocols with long operating histories and significant production usage within their respective categories.

Economically, Boost is beneficial for both users and Vault owners. While users receive enhanced rewards, Vault owners receive increased revenue and a material improvement in unit economics without increasing user acquisition costs. Every 1 osETH deposited into Boost results in 5–13 additional ETH staked in the Vault, increasing recurring revenue per deposited ETH from ~0.0015 ETH to ~0.009–0.021 ETH for Vault owners.

Integration details

Each Vault owner offering Boost has two options: to allow Boost via the StakeWise UI (available automatically upon Vault deployment, unless explicitly hidden at the owner’s request), or to use the StakeWise SDK to enable entering and exiting Boost from within their own application.

This gives every Vault owner the flexibility to present StakeWise Boost and considerations about its risk and reward as they see fit for their user base.

Results

As a yield amplification strategy, Boost has driven significant increases in total assets staked for the Vaults that actively pitched the product:

Genesis Vault: from 64K ETH to 165K ETH in total assets staked within 11 months

Chorus One - MEV Max Vault: from 21K ETH to 62K ETH in total assets staked within 8 months

NodeSet Vault: from 2.6K ETH to 32K ETH in total assets staked within 7 months

In terms of user income, actual performance data demonstrates a 4.047% return to date, or 4.415% annualized, based on the performance of the Genesis Vault. Note that past performance does not guarantee future returns.

StakeWise Boost shows how a DeFi-native strategy can deliver meaningful yield enhancement with a conservative and transparent risk profile by combining staking infrastructure with blue-chip lending markets through a seamless user experience.

To learn more about how StakeWise Boost works, review performance data, or explore how Boost can be integrated into staking products or applications, visit the StakeWise app or reach out to the team for additional information at info@stakewise.io.