NodeSet’s Use Case

In April 2025, NodeSet launched a best-in-class decentralized staking offering powered by StakeWise.

NodeSet is a collective of over 100 individual node operators located all over the globe. Each operator runs only a few validators, dramatically reducing the risk of correlated slashing that can be present in single node operator setups. This structure enables a more resilient, decentralized staking experience designed to scale without sacrificing fault isolation.

NodeSet’s offering is focused on HNWIs and institutions, and is built around a private Vault with a whitelist. To further optimize MEV outcomes within a controlled institutional framework, NodeSet joined the smoothing pool for MEV.

When designing its product, NodeSet wanted a setup that combined institutional-grade control with true decentralization of validator operations. Specifically, NodeSet wanted:

1. A pooled staking setup with liquidity and DeFi optionality. The goal was to provide a streamlined staking experience while giving clients the ability to access broader capital efficiency when needed.

2. Seamless integration into a decentralized node infrastructure. NodeSet needed a model that could natively support its distributed operator collective rather than forcing a centralized node operator approach.

3. A flexible fee structure. NodeSet required the ability to configure fees in a way that fit both institutional expectations and the realities of operating a large decentralized set of independent operators.

StakeWise fit the bill perfectly.

Decentralized Pooled Staking: Powered by StakeWise

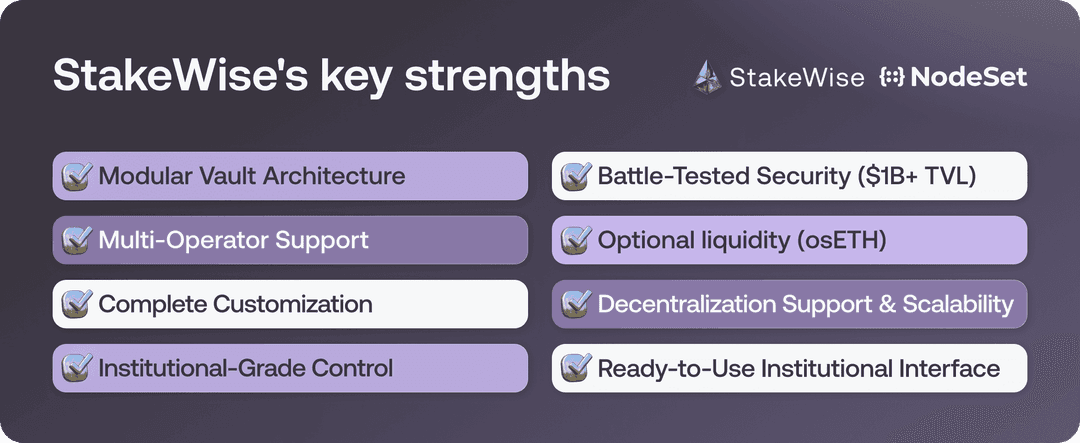

StakeWise Vaults were a perfect match for NodeSet’s requirements in terms of capabilities, operational flexibility, and decentralization support.

Based on a modular architecture, StakeWise Vaults are isolated, highly customizable staking pools where the parameters are controlled by the pool owner. This allowed NodeSet to:

1. Launch a private, institutional-facing Vault with a whitelist

2. Structure fees in a way that supports a multi-operator decentralized model

3. Integrate pooled staking into a globally distributed collective of independent node operators

4. Join a MEV smoothing pool to align outcomes across a diverse operator set

5. Offer users optional access to a liquid staking token, osETH, for liquidity and DeFi strategies

A key advantage of this design is that users who prefer a straightforward institutional pooled staking experience can remain in that path, while those who want liquidity and DeFi utility can opt into osETH—a token widely integrated across protocols such as Aave, Compound, Fluid, EigenLayer, and others.

Importantly, a comparable setup is effectively impossible to run elsewhere due to constraints around using a decentralized, multi-operator node network in other protocols. StakeWise Vaults uniquely support this structure without forcing NodeSet into a single-operator model.

Integration Details

NodeSet’s staking product is based on a dedicated StakeWise Vault configured to match institutional requirements and the operational realities of a decentralized node collective.

Clients utilize the StakeWise Vaults interface for interacting with the NodeSet Vault. The interface offers full functionality, including:

Complete rewards and APY statistics on an individual level

Performance views over different time periods

Data export

This delivers a strong institutional-grade experience for monitoring performance, reporting, and internal analytics—without requiring NodeSet to build a separate front end for advanced user needs.

Results

Since launching in April 2025, NodeSet has established a compelling model for decentralized, institution-ready pooled staking.

By combining:

A collective of over 100 globally distributed operators

An architecture where each operator runs only a few validators

A private, whitelisted Vault for HNWIs and institutions

MEV smoothing pool participation

Optional liquidity and DeFi utility via osETH

A robust, ready-to-use institutional interface through StakeWise

NodeSet has delivered a staking product that pairs decentralized resilience with a controlled, high-trust client experience.

We are proud to support NodeSet’s mission to make decentralized staking viable at institutional standards and to provide the Vault infrastructure that enables this model.

If you are interested to learn more about the NodeSet use case, or want to discuss using StakeWise Vaults for your own decentralized pooled staking solution, do not hesitate to contact the team for more information: info@stakewise.io